UX Case study

Transaction details for Chase mobile

JP Morgan Chase, 2018

UX case study

Transaction details for Chase Mobile

JP Morgan Chase, 2018

UX case study

Transaction details for Chase mobile

JP Morgan Chase, 2018-2019

Project overview

This redesign project is part of an effort by Chase to reduce costs in customer service calls by creating more self-servicing features across our digital platforms. I was tasked in finding out what to improve in the mobile app’s transaction details experience to help these efforts.

Project overview

This redesign project is part of an effort by Chase to reduce costs in customer service calls by creating more self-servicing features across our digital platforms. I was tasked in finding out what to improve in the mobile app’s transaction details experience to help these efforts.

Project overview

This redesign project is part of an effort by Chase to reduce costs in customer service calls by creating more self-servicing features across our digital platforms. I was tasked in finding out what to improve in the mobile app’s transaction details experience to help these efforts.

Empathizing with Chase customers

Empathizing with Chase customers

Empathizing with Chase customers

Looking at quantitative data from customer service calls, there were 3 key points I wanted to understand through user research about why customers were calling.

41%

of all calls were made to better understand transactions

16%

of those calls were regarding valid transactions but not recognized by customers

65%

of issues could have been directly resolved with the original merchant and not with Chase

USER RESEARCH OVERVIEW

I wanted to understand how customers viewed the current transaction details experience and how they prioritized and contextualized information in regards to transaction validity in the mobile app.

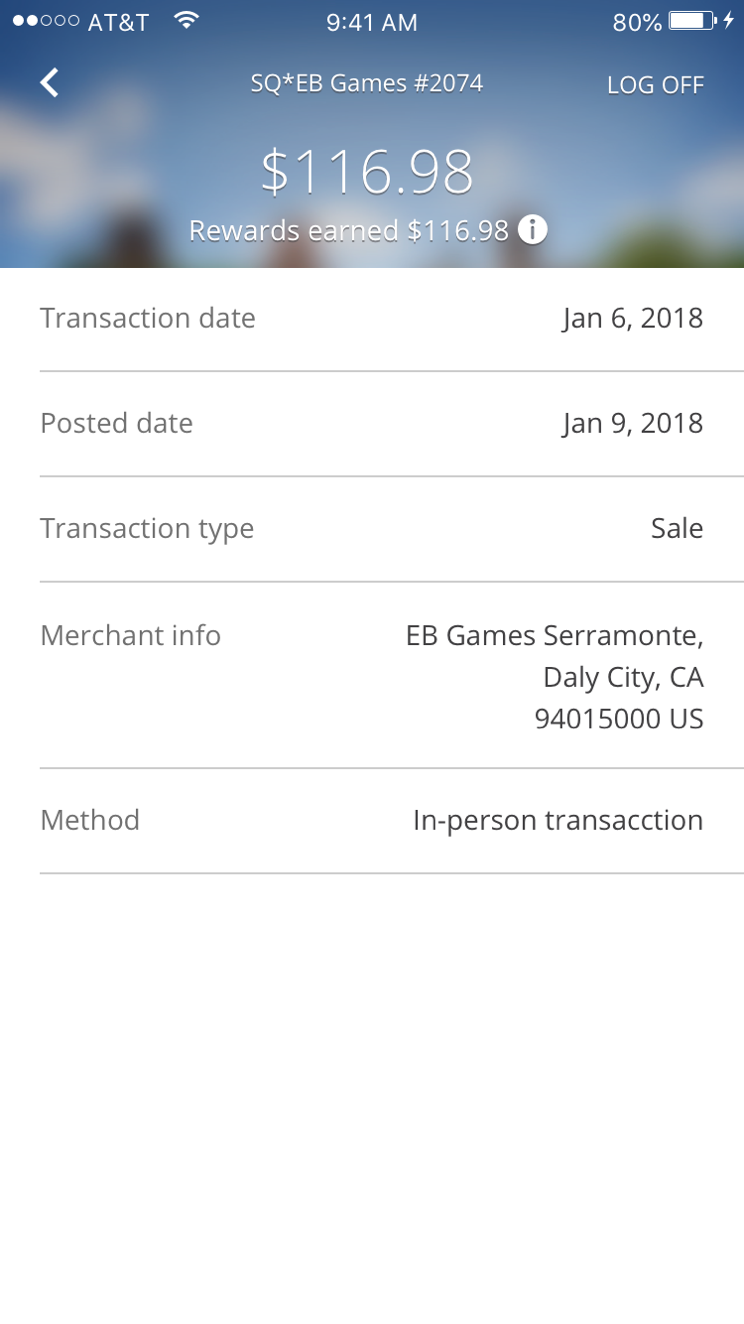

So, in the first part of the research study, I had participants give feedback on the current design in regards to how they felt if this transaction appeared invalid. Then, I switched to a proposed experience and observed their reactions.

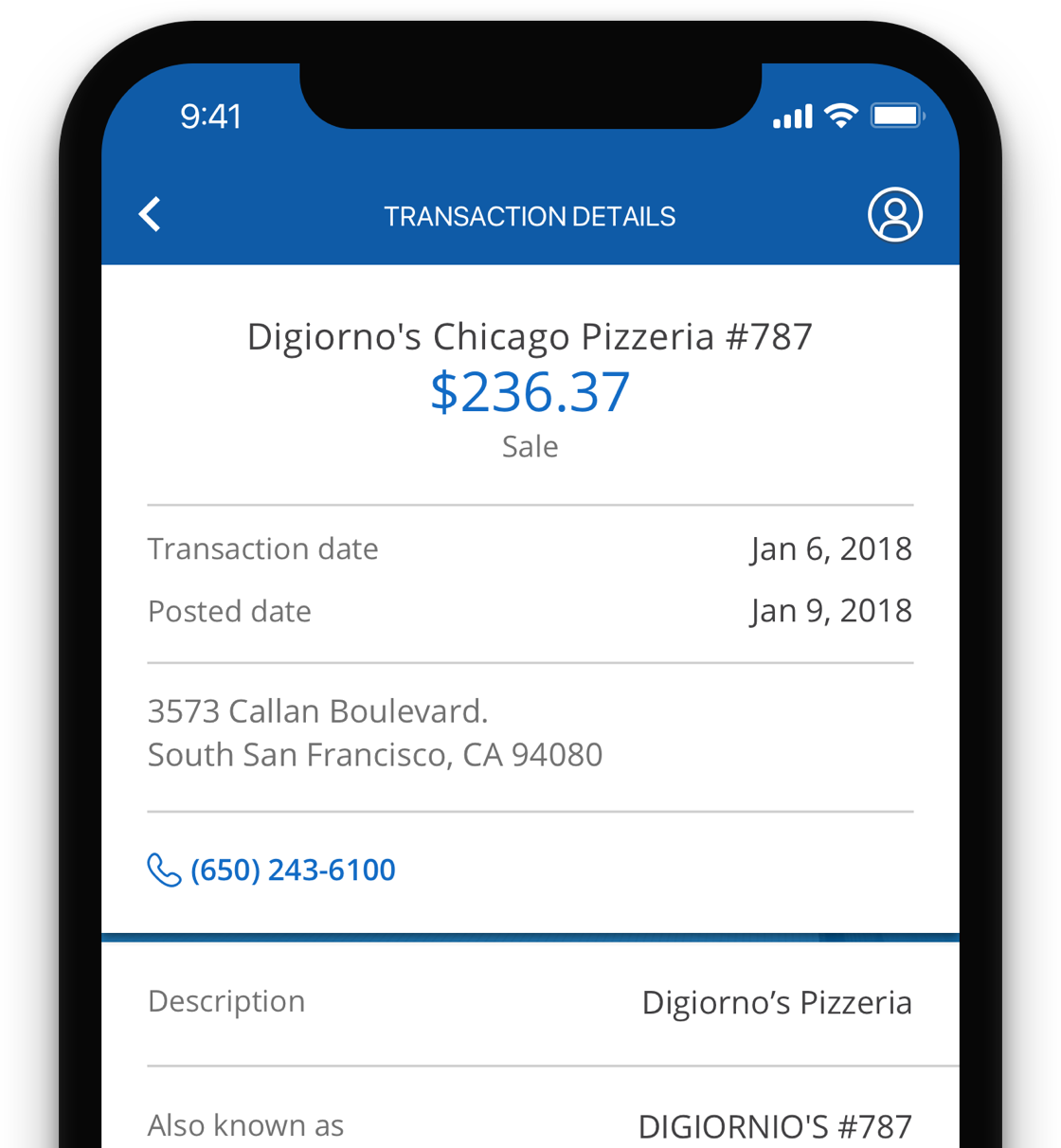

CURRENT EXPERIENCE

PROPOSED EXPERIENCE

In the last part of the study, I had participants do a card sorting exercise with content of the proposed design where they ranked the most to least important elements in determining validity. The top 4 elements were:

- Merchant contact information

- Past transaction history

- Cardholder name

- Map

RESEARCH FINDINGS SUMMARY

- Participants felt the current experience lacked any information and wanted more details to satisfy their curiosity and need to ensure validity.

- Any uncertainties in a transaction made users want to contact someone for validity. And their first reaction is to contact Chase because there is no contact information available.

- Users determine transaction validity based on who the merchant was, not the individual who made the transaction.

- Contact information was the most important detail for transaction validity.

Defining user archetypes & the problem statement

Empathizing with Chase customers

Empathizing with Chase customers

Building from my research study, I formulated three Chase customer archetypes and a problem statement to define my design.

THE MONITOR

“Anything the bank knows, I want to know.”

Behaviors

Constantly uses the Chase app to check their transactions and monitor account activity to ensure accuracy.

Need & Goal

Constantly uses the Chase app to check their transactions and monitor account activity to ensure accuracy.

THE UNCERTAIN

“If I could I understand this better, I wouldn’t have to call someone.”

Behaviors

Calls Chase after seeing any unfamiliar transaction in their account when it was actually valid.

Need & Goal

To understand who the merchant is so they won’t waste time contacting Chase for something that was already valid.

THE WRONGFUL ACCUSERS

“Oops, I didn’t know I needed to do that instead.”

Behaviors

Calls Chase to do something they must do with the merchant, like unsubscribing from a service being billed to their account.

Need & Goal

To contact the merchant to resolve their problem.

PROBLEM STATEMENT

Chase customers need more detailed transaction information and a way to contact the merchant in order to:

- Better understand and recognize transactions they make so they would not need to waste their time calling Chase customer service.

- Avoid unnecessary contact with Chase when they should be dealing with the merchant.

Design explorations & the final solution

Empathizing with Chase customers

Empathizing with Chase customers

Now that I know my users’ needs & goals, these were the solutions and prototypes I explored, leading to the final design.

REFINEMENTS

In my research study, participants were overwhelmingly satisfied with the information available on the proposed design in regards to determining transaction validity.

However, the elements could be organized better, based on user feedback and the input from my peers and stakeholders. I also needed to approach this design in a more modular and scalable way to support phased releases of features because some features aren’t going to be available at launch (i.e. the map).

FINAL SOLUTION

For the Monitor, every use case will include any relevant data about a transaction available to the bank to satisfy their urge to always know everything going on with their account

For the Uncertain Ones, merchant identity is improved by showing all the names it goes by, contact information, and location so customers can recognize them without needing help from Chase customer service.

For the Wrongful Accusers, we included an indicator for a recurring merchant charge and a link to call the merchant in case they wanted to learn more about it or cancel it.

Conclusions

The first phase of this project was released in Q4 of 2018 and initial customer feedback from reviews has been positive. There is on-going development with other enhancements and features coming in 2019. Cost savings and other success metrics are yet to be determined.

Portfolio

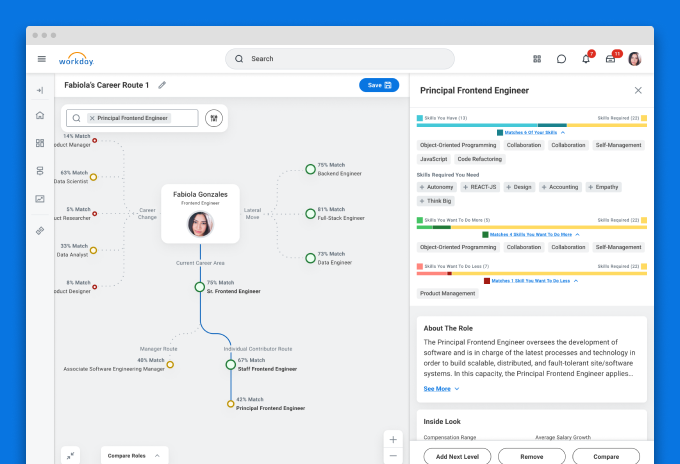

Career exploration for Workday's Career HubProduct Design

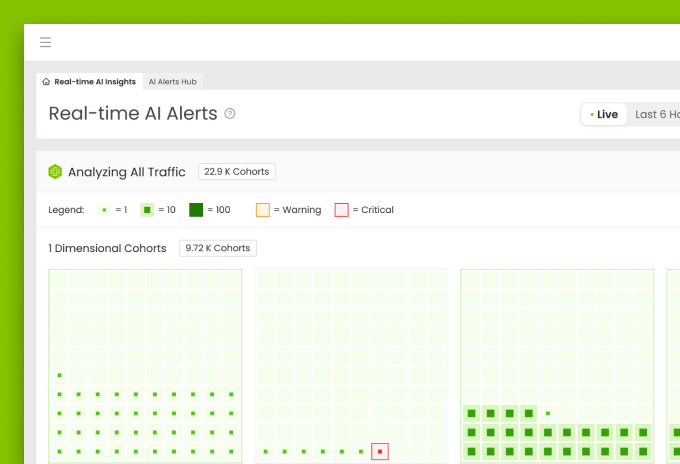

Real-Time AI AlertsData Visualization

AWS Glue StudioUX Case Study

Visual authoring interface for AWS Glue StudioUX Case Study

Asurion Virtual AgentUI Design

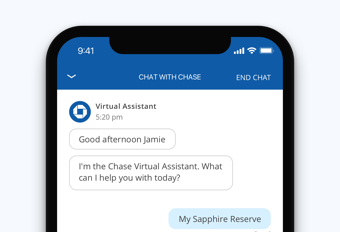

Chase mobileUI-UX Design

Enhanced chat for Chase mobileUI-UX design

Upgrade systems for Rival FireUX case study

UI for James Bond 007: World of espionageDesign system